MFS meeting

This Macro Finance Society-meeting takes place over two days, where the second day will be in the Norwegian Academy of Science and Letters. Paul Ehling is the CAS PI for the project Asset Pricing with Heterogeneous Investors in Overlapping Generations, and the organiser for this event.

Provisional Programme (subject to change)

08:30-09:00 Coffee

08:50-09:00 Welcome

9:00-09:50 “The Corporate Bond Factor Zoo” by Alexander Dickerson (University of New South Wales, AU), Christian Julliard (London School of Economics, UK), and Philippe Mueller (Warwick University, UK).

Discussant: Irina Zviadadze (HEC Paris Business School, FR).

09:50-10:40 “Intangible capital, non-rivalry, and growth” by Nicolas Crouzet (Northwestern University, US), Janice Eberly (Northwestern University, US), Andrea Eisfeldt (University of California, Los Angeles, US), and Dimitris Papanikolaou (Northwestern University, US)

Discussant: Chang-Tai Hsieh (University of Chicago Booth School of Business, US)

10:40-11:00 Break

11:00-11:50 “Debt and Deficits: Fiscal Analysis with Stationary Ratios” by John Y. Campbell (Harvard University, US), Can Gao (University of St. Gallen, CH), and Ian W. R. Martin (London School of Economics, UK)

Discussant: Bernard Dumas (INSEAD, FR)

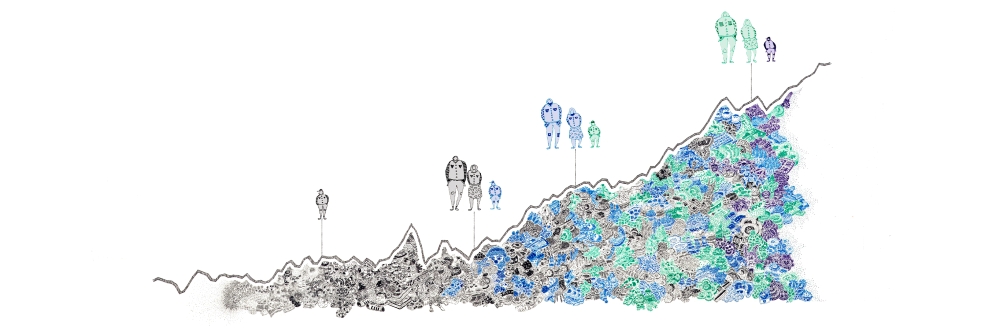

11:50-12:50 Keynote address: “Rethinking capitalism: the power of creative destruction” by Philippe Aghion (INSEAD, FR, and London School of Economics, UK)

12:50-14:00 Lunch and PhD poster session:

– “Bank Funding to Nonbank Financiers: Risk-Sharing or Regulatory Arbitrage?” by Clara (Chi) Xu (Wharton School, US)

– “Pricing Disaster Risk in Corporate Bonds” by Cynthia Yin (Ohio State University, US)

– “Asset Purchase Programs and the Exchange Rate” by Sinem Yagmur Toraman (Johns Hopkins University, US)

– “The Rise and Fall of Investment: Rethinking Q theory in Equilibrium” by Xinwei Li and Xinyu Liu (INSEAD, FR)

– “Somebody Stop Me: The Asset Pricing Implications of Principal-Agent Conflicts” by Juan Carlos Zelaya-Mejıa (BI Norwegian Business School, NO)

14:00-14:50 “Risk from the Inside Out: Understanding Firm Risk through Employee News Consumption” by Fahiz Baba-Yara (Indiana University, US), Fotis Grigoris (University of Iowa, US), and Preetesh Kantak (Indiana University, US)

Discussant: Joel Peress (INSEAD, FR)

14:50-15:10 Break

15:10-16:00 “Corporate tax avoidance, firm size, and capital misallocation” by Brent Glover (Carnegie Mellon University, US) and Oliver Levine (University of Wisconsin–Madison, US)

Discussant: Gian Luca Clementi (New York University, US)

16:00-16:50 “Unlocking Mortgage Lock-In: Evidence From a Spatial Housing Ladder Model by Julia Fonseca (University of Illinois at Urbana-Champaign, US), Lu Liu (Wharton School, US), and Pierre Mabille (INSEAD, FR)

Discussant: Paul Willen (Federal Reserve Bank of Boston, US)

16:50 Dinner in the Academy