The Debt Capacity of a Government

This lunch seminar is given by PI Paul Ehling of the "Asset Pricing with Heterogeneous Investors in Overlapping Generations" project.

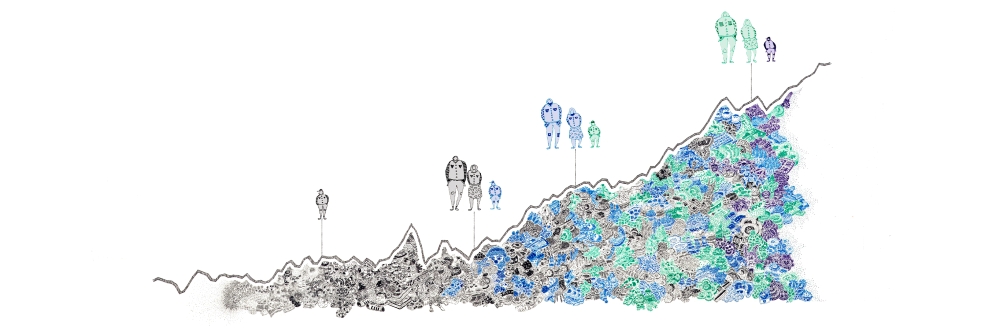

Abstract: Fiscal costs of excessive debt should be assessed dynamically reflecting anticipated growth, deficits and interest rates. Studying their joint behavior, with overlapping generations and structural deficits arising from social security, we define government debt capacity as the level that can be just sustained with current fiscal parameters unchanged all the way to an unstable steady state, in which primary deficits last forever. Below capacity, debt converges to a stable steady state. Above capacity, debt unravels. Exceeding capacity without unraveling requires higher future taxes or reduced expenditures, which is the true fiscal cost.